Retained Earnings are debited in the Income Statements. It is now incorrect to show them in the PL as they are a distribution of reserves not an.

The dividends account is a temporary equity account in the balance sheet. Accounting for dividends paid projected pl and balance sheet. For accounting periods starting after 1 January 2005 dividends need to be shown as a debit against equity. Paying the dividends reduces the amount of retained earnings stated in the balance sheet.

Accounting for dividends paid projected pl and balance sheet.

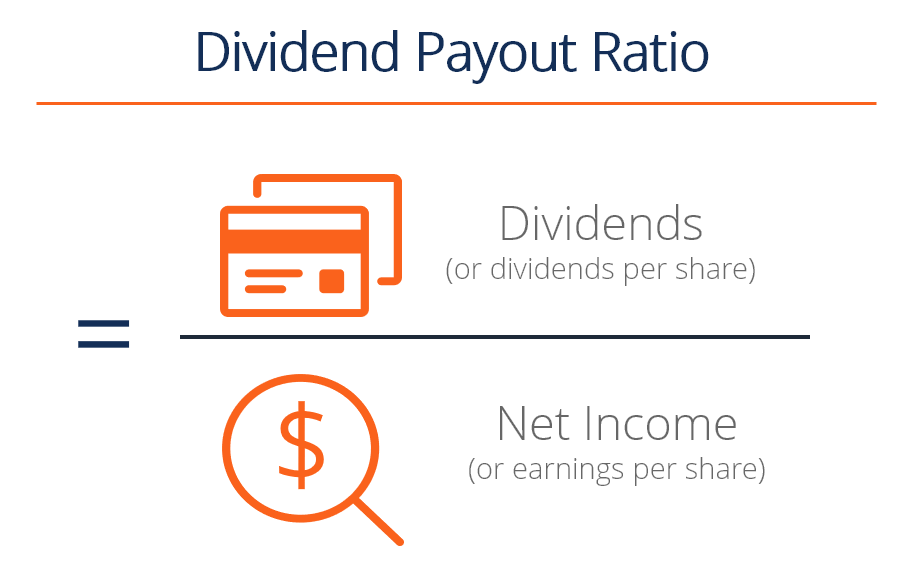

Dividend Payout Ratio Formula Guide What You Need To Know Common Size Statement Example Free Profit And Loss Template

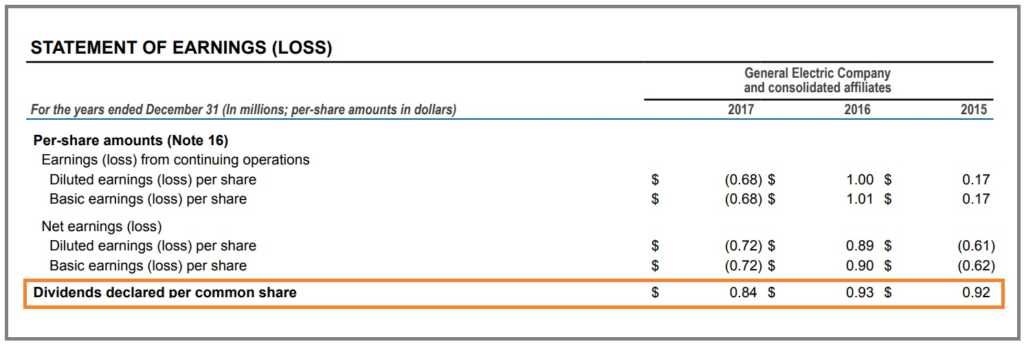

Whether youre paying dividends in cash or stock youll want to recognize and record them according to the date the. Line items is typically done in conjunction with projecting income statement line items. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. The dividends declared and paid by a corporation in the most recent year will be reported on these financial statements for the.

Dividends paid payable used to be shown in the PL account but that changed a few years back. Where Dividends Appear on the Financial Statements. Current Liabilities increase in the Balance Sheet.

Ad Free Trial – Track Sales Expenses Manage Inventory Prepare Taxes More. This means that to finish projecting balance sheet line items its handy to first finish projecting income statement line items so as to have net income readily available. The account Dividends or Cash Dividends Declared is a temporary stockholders equity account that is debited for the amount of the dividends that a corporation declares on its capital stock.

Retained Earnings Formula And Excel Calculator Fox Financial Statements Bd Bank Statement

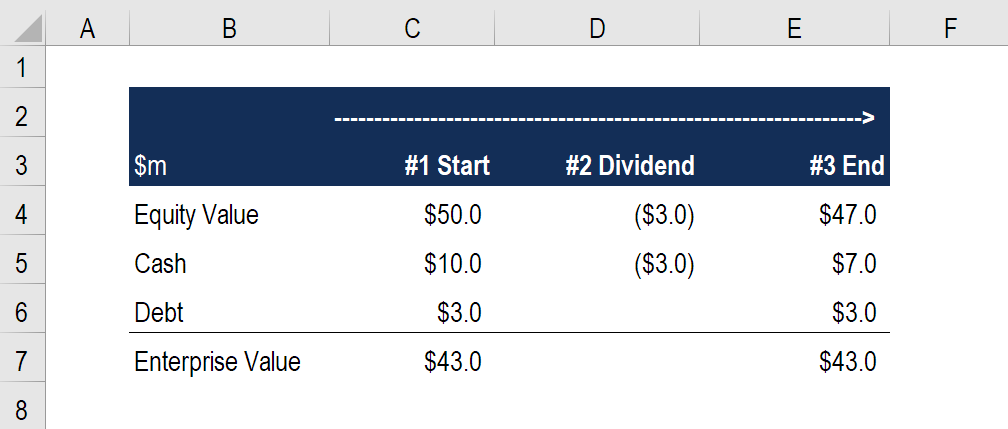

Subsequently when dividends are paid. Easily Approve Automated Matching Suggestions or Make Changes and Additions. Dont worry your balance sheet will still balance since there will be offsetting changes. Amazing Accounting For Dividend And Retained Earnings Projected Balance Sheet In Excel Preparing a projected balance sheet or financial budget involves analyzing every balance sheet.

Net Profit for distribution. How to post dividends on SAGEPL Balance Sheet based on following example. Holding Companys share of such dividend.

If a balance sheet is prepared between the date of declaration of cash dividends and the date of actual payment of cash to stockholders the balance in the dividends payable. Declaring and paying dividends will change your companys balance sheet. For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online.

What Are Retained Earnings Guide Formula And Examples Paying Interest Expense Receiving Revenue Of P&l Balance Sheet Template

Accounting for dividends received projected profit and loss account and balance sheet in excel. Ad Free Trial – Track Sales Expenses Manage Inventory Prepare Taxes More. When a subsidiary company proposed the dividend it debits its Profit and Loss Appropriation Account and credits Proposed Dividend Account. For accounting periods starting after 1 January 2005 dividends need to be shown as a debit against equity.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. When a dividend is later paid to shareholders debit the Dividends Payable account and credit the Cash account thereby reducing both cash and the offsetting liability. Simply reserving cash for a future dividend payment has no net impact on the.

After your date or record. The balance on the dividends account is transferred to the retained earnings it is a distribution of. As always the balance.

Dividends In A Three Statement Model Youtube Cash Flow And Income Woolworths Financial Statements 2019

For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Accounting for dividends paid is a relatively simple process. This is usually either shown as a note to the balance sheet showing a. Easily Approve Automated Matching Suggestions or Make Changes and Additions.

Current Liabilities are debited in the.

Dividend Definition Examples And Types Of Dividends Paid Private Company Balance Sheet Sony

Dividend Payout Ratio Formula And Excel Calculator What Is Included In The Post Closing Trial Balance Financial Statement Analysis Example

Dividend Definition Examples And Types Of Dividends Paid Restaurant Brands International Balance Sheet Establishment Expenses In Trial

Dividend Yield Formula And Calculator Excel Template For Income Expenditure Standard Financial Statement

/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)

Retention Ratio Definition Balance Sheet And Profit Loss Account Of A Company Condensed For Bradford Corporation

Statement Of Cash Flows How To Calculate Dividends Youtube Financing Activities Examples Flow Three Major Financial Statements

Originally posted 2025-03-20 23:07:16.